Personal Bankruptcy

Personal bankruptcy provides you with immediate protection against collection or legal action by your unsecured creditors, including the Canada Revenue Agency. The purpose of personal bankruptcy is to provide an individual with a fresh financial start.

What is personal bankruptcy?

When compared to other debt restructuring plans, personal bankruptcy is usually the least expensive and quickest option to eliminate your debt, taking as little as nine (9) months to complete.

To file a personal bankruptcy, you must:

- owe at least $1,000;

- be unable to make or stopped making your regular monthly payments to your creditors as they become due; or

- have an insufficient amount of proceeds from the sale of all your assets and property at fair market value to pay all your debts or obligations in full.

When you file personal bankruptcy, you are voluntarily entering into a legal process that provides you with immediate protection against any further action by your unsecured creditors including the Canada Revenue Agency for income tax or Good and Service Tax debt. Once you enter into bankruptcy, you will need to be discharged from bankruptcy or released from bankruptcy to obtain your fresh start. Your discharge from bankruptcy will release you from bankruptcy and any further legal responsibility regarding your unsecured debts.

If you are filing bankruptcy for the first time and have no surplus income, the length of the bankruptcy is nine (9) months. If you have surplus income, the length of the bankruptcy is twenty-one (21) months.

If you are filing bankruptcy for a second time and have no surplus income, the length of the bankruptcy is twenty-four (24) months. If you have surplus income, the length of the bankruptcy is thirty-six (36) months.

Contact us today

Contact us to learn more about money management techniques and debt repayment strategies to manage your finances and eliminate your debt.

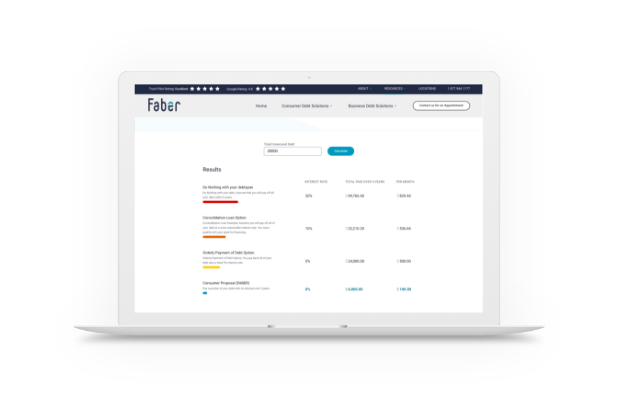

See how we can help